Accounting Worksheet Income Summary

The Income Summary account reflects all entries in the Income Statement section of the worksheet. An accounting journal is an accounting worksheet that allows you to track each of the steps of the accounting process side by side.

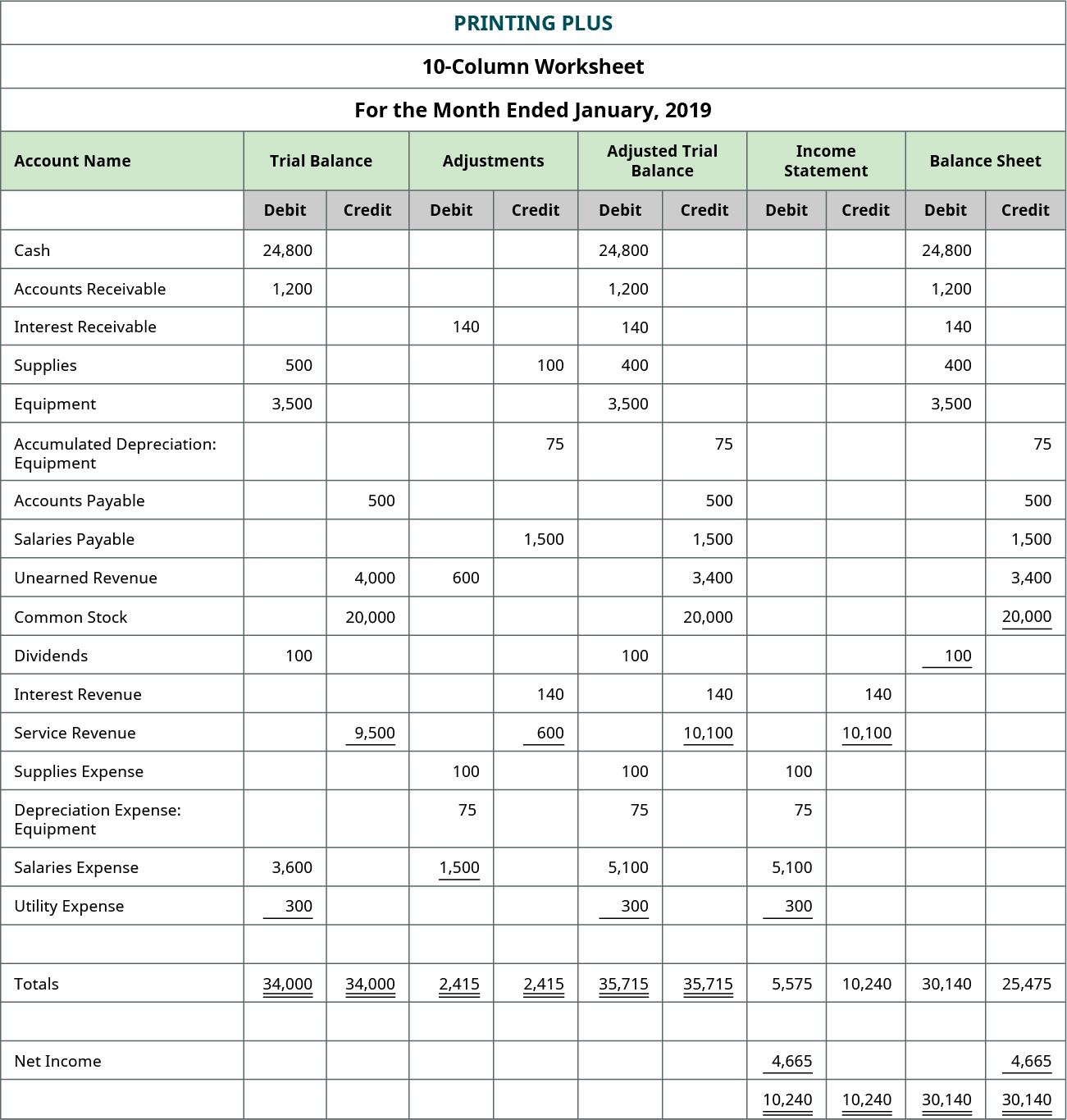

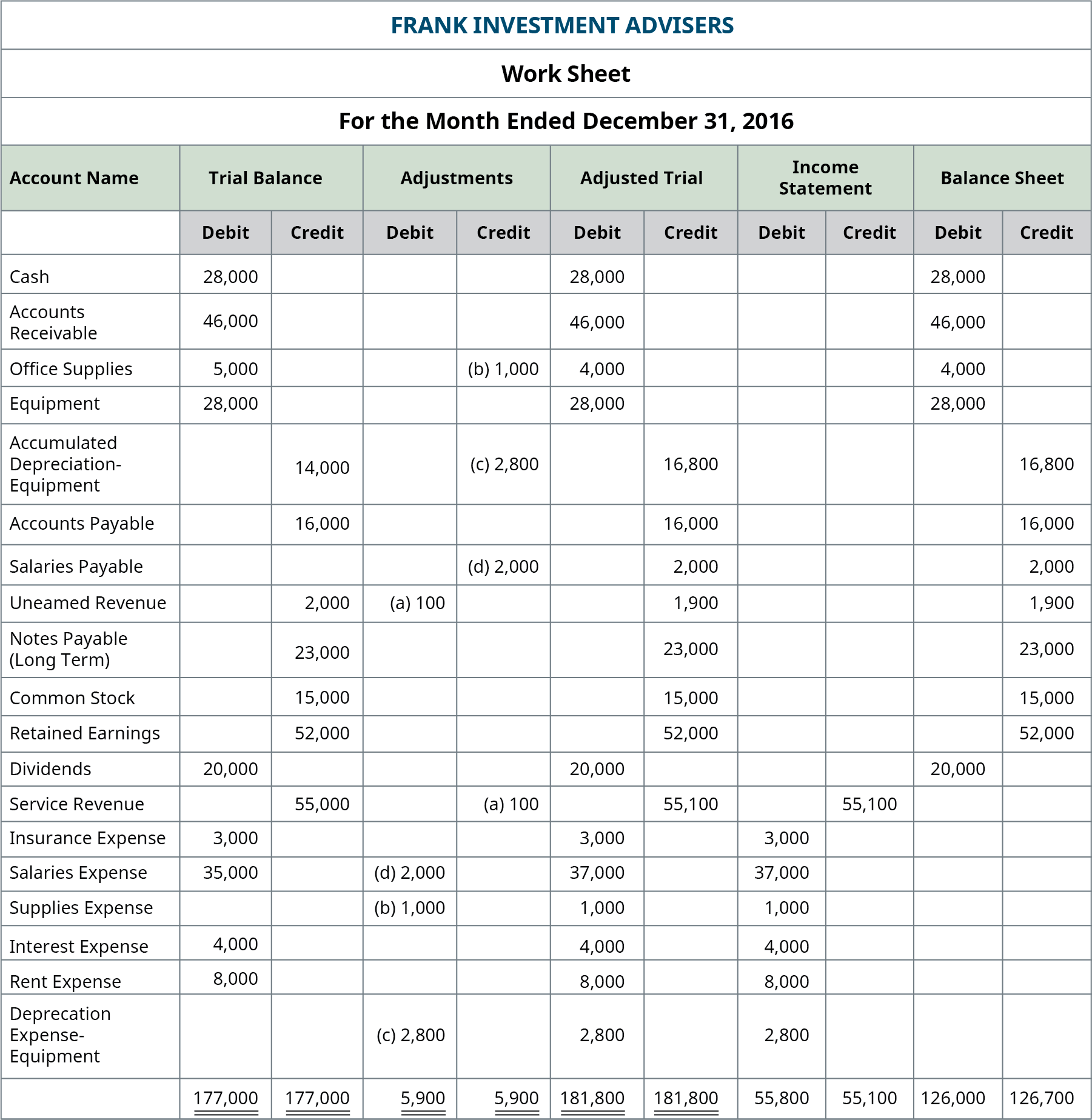

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Balance 22633 Closing 35000 Net Income.

Accounting worksheet income summary. A summary of the revenue and the expense of a business entity for a specific period of time such as a month or a year. What is Income Summary. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

A worksheet is a useful tool in order to ensure that the accounting entries The Accounting Entries Accounting Entry is a summary of all the business transactions in the accounting books including the debit credit entry. 27 rows An accounting worksheet is large table of data which may be prepared by. The difference either net income or.

It has 3 major types ie Transaction Entry Adjusting Entry Closing Entry. Gather adjustment information and complete a worksheet. The use of a worksheet is an optional step in the accounting cycle.

What is the Income Summary Account. The Accounting Cycle Step 7 Journalize and post closing entries Step 1 Analyze transactions Step 2. In other words the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made.

The account is debited for expenses and credited for revenues. Balance 22633 Closing 35000 Net Income. The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period.

In the closing stage balances in all income accounts are. The net amount transferred into the income summary account equals the net profit or net loss that the business incurred during the period. A summary of the changes in the earnings retained in a business entity for a specific period of time such as a month or a year.

Use this income statement template to create a single-step statement that groups all revenue and expenses. Total COST paid for prepared foods while on business travel accountant will figure 50 of this amount to write off Utilities Total COST of utilities not paid for a home office gas electric water sewer garbage internet security. Thus shifting revenue out of the income statement means debiting the revenue account.

This means that the value of each account in the income statement is debited from the temporary accounts and then credited as one value to the income summary account. The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net income or net loss for the period.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The statement provides a summary of the companys revenue and expenses along with the net income. Income Summary is a temporary account that is used in the closing process.

- Introduction to Accounting Chapter 6 - Closing Entries and the Post Closing Trial Balance Prof. 31 Income Summary 309 1236700 Salaries Expense 511 700000. The income summary account is a temporary account used to store income statement account balances revenue and expense accounts during the closing entry step of the accounting cycle.

A worksheet is not a permanent accounting record. Discover learning games guided lessons and other interactive activities for children. The income summary account is a dummy account.

The net balance of the income summary account is closed to the retained earnings account. Now that it has served its purpose we will get rid of it. Discover learning games guided lessons and other interactive activities for children.

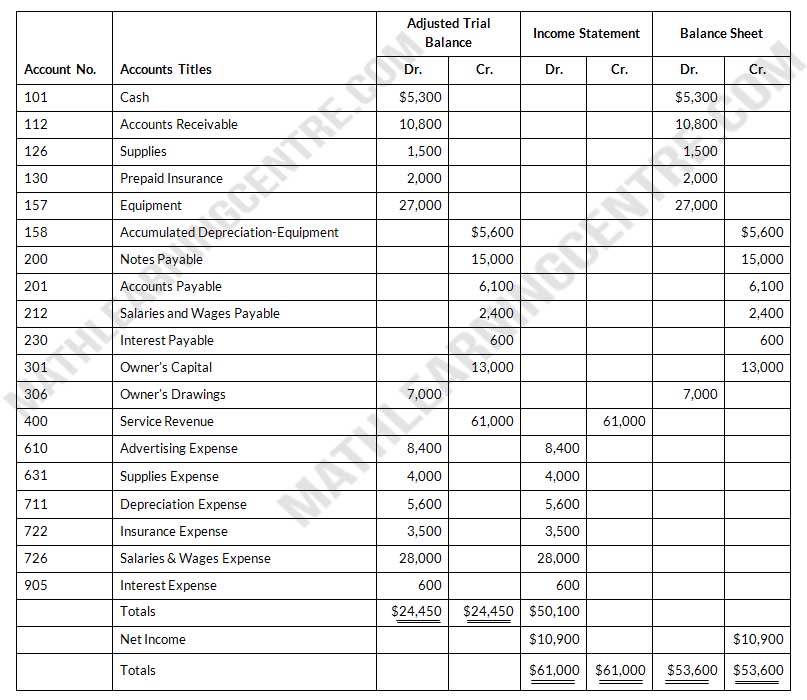

The Adjusted Trial Balance Columns Of The Worksheet For Thao Company

Can You Help Me Fill This Income Summary Out With The Chegg Com

Glencoe Mcgraw Hill Accruals Deferrals And The Worksheet Ppt Download

Fin1030 Project 2 Training Room 1 Page 2

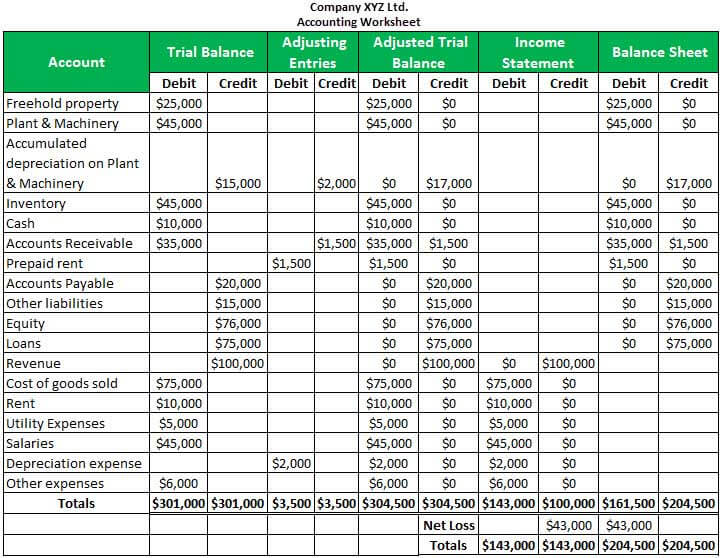

Accounting Worksheet Example Benefits Limitations Preparation

Financial Statement Reporting Accounting Cycle Classified Balance Sheet

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

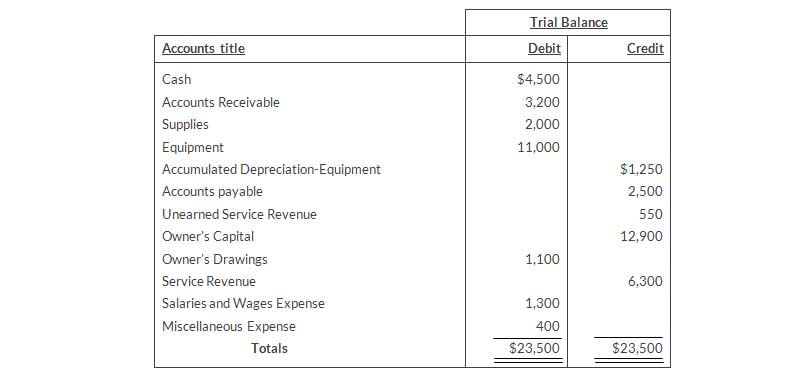

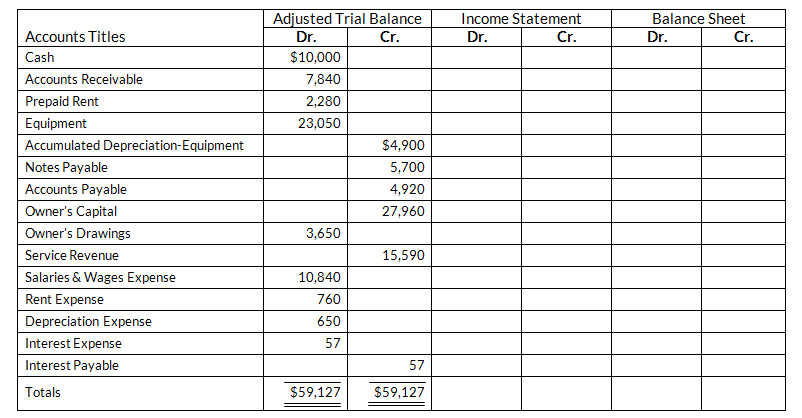

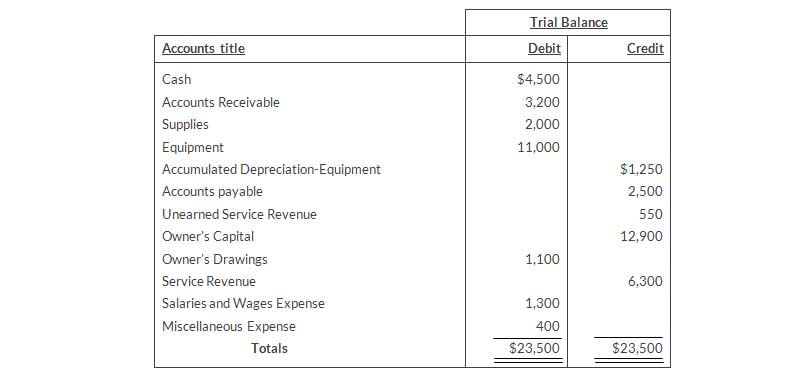

Worksheet Data For Savaglia Company Are Present As Follows

Completing The Accounting Cycle

Accounting Worksheet Format Example Explanation

Accounting An Introduction Adjusting And Closing Journal Entries

Accruals Deferrals And The Worksheet Section 2 Completing The Worksheet Chapter 12 Section Objectives 4 Complete A Ten Column Worksheet Mcgraw Hill C Ppt Download

Use The Following Worksheet To Answer The Following Chegg Com

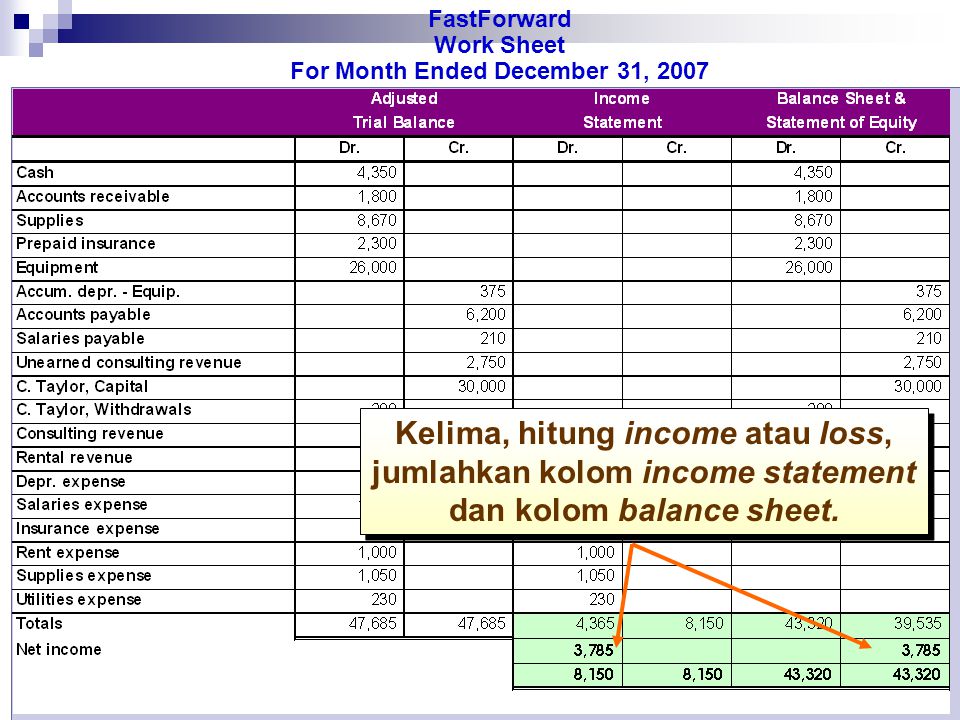

Penyusunan Laporan Keuangan Dan Jurnal Penutup Ppt Download

Accounting Worksheet Definition Example Of Accounting Spreadsheet

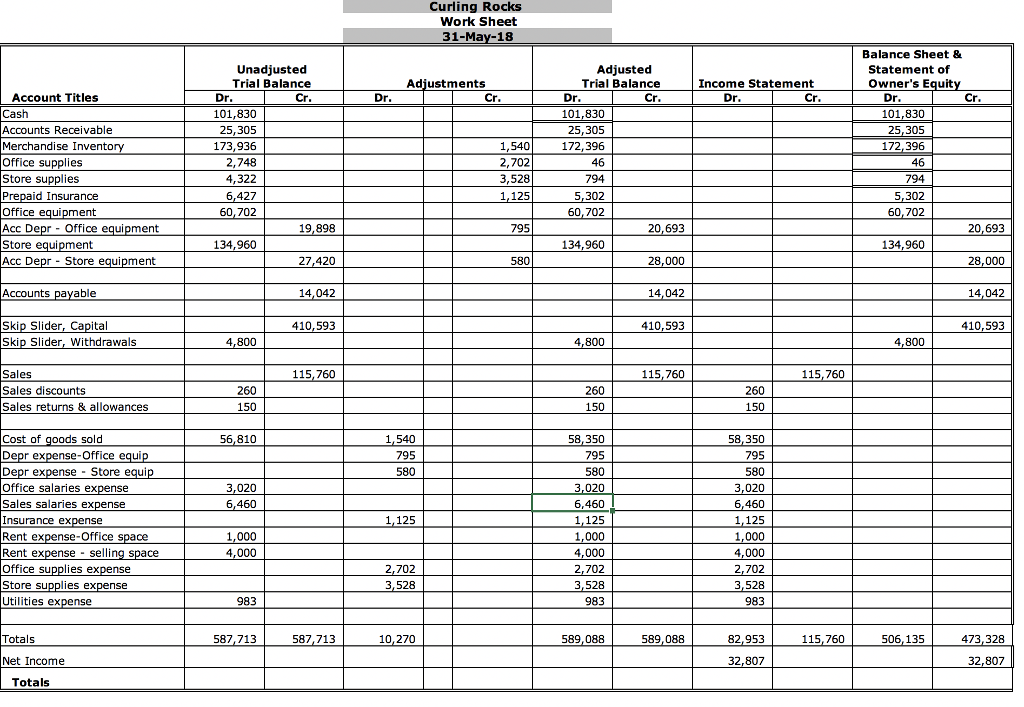

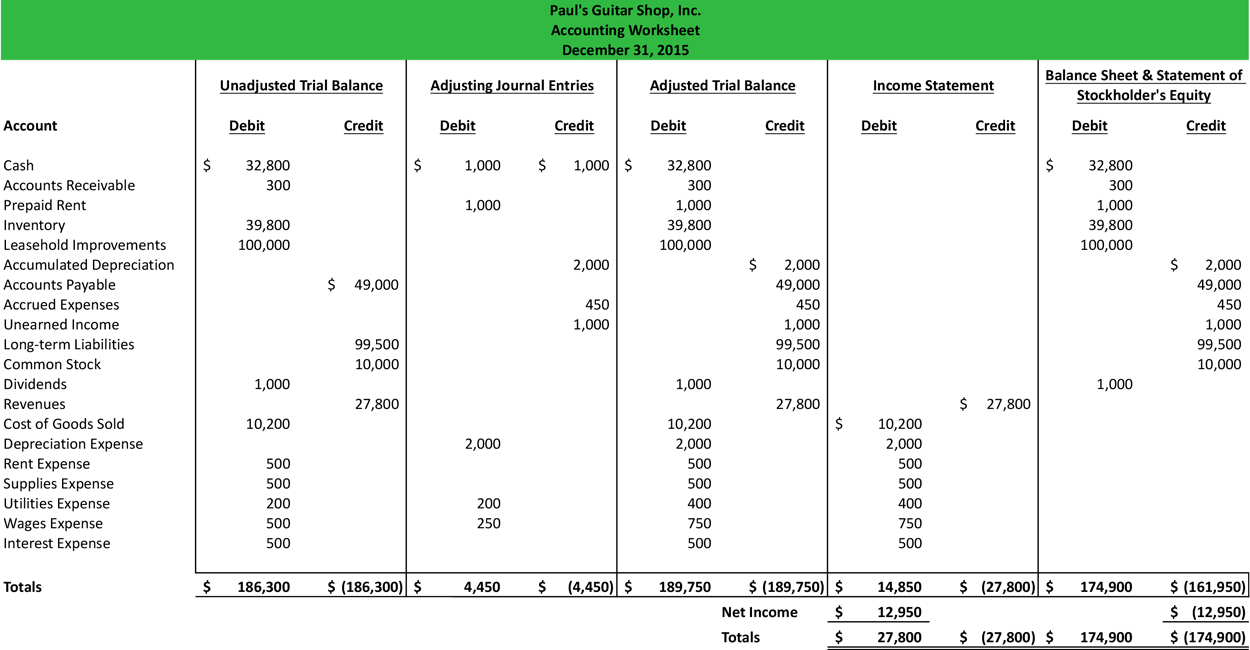

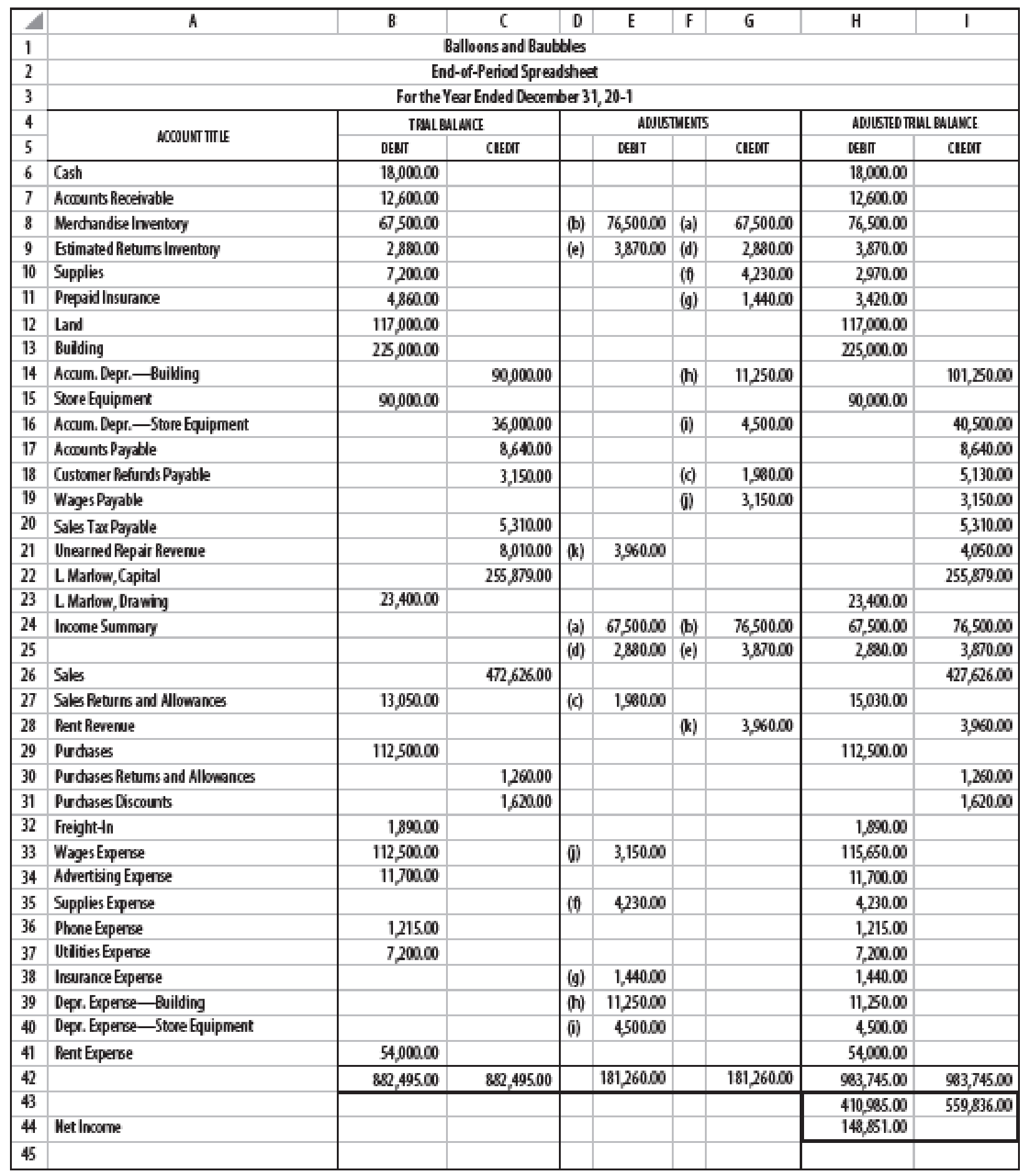

Closing Entries Using The Spreadsheet And Partially Completed Income Summary Account On Page 605 Prepare The Following 1 Closing Entries For Balloons And Baubbles In A General Journal 2 A Post Closing Trial